Hi,

This is the first newsletter in a series we’re launching to share our journey, insights, and learnings with anyone interested in creator brands, the creator economy, and in general the latest trends and developments in the consumer sector.

We’re starting with a framework we often use at Vivaio to help ourselves and our clients gain clarity and control over financial performance.

Developed by Common Thread Collective, it’s called the 4-Quarter Accounting Model.

How It Works

The model breaks down your P&L into four simple categories, all shown as a percentage of net revenue.

CAC (Customer Acquisition Cost): This includes everything you spend to bring in new customers such as paid ads (e.g. Meta), influencer campaigns, events, etc.

COD (Cost of Delivery): These are the costs tied directly to getting your product into the hands of your customer including COGS, packaging, shipping, and payment processing fees.

OPEX (Operating Expenses): These are your fixed operating costs such as salaries, rent, software subscriptions, and general overhead.

Profit: What’s left over after all your costs.

The Goal? A healthy 25% balance. At maturity, a well-optimized DTC business should aim for a balanced 25% split across CAC, COD, OPEX, and Profit, signalling strong unit economics and a sustainable path to long-term profitability.

Why It Matters

Traditional P&Ls often bury the signal in complexity. The 4-Quarter Model helps brands see, at a glance, how revenue is being allocated and where the gaps or inefficiencies might be. It’s not about chasing a “perfect” 25% split across all four areas but understanding your business’s financial DNA based on its stage and strategy.

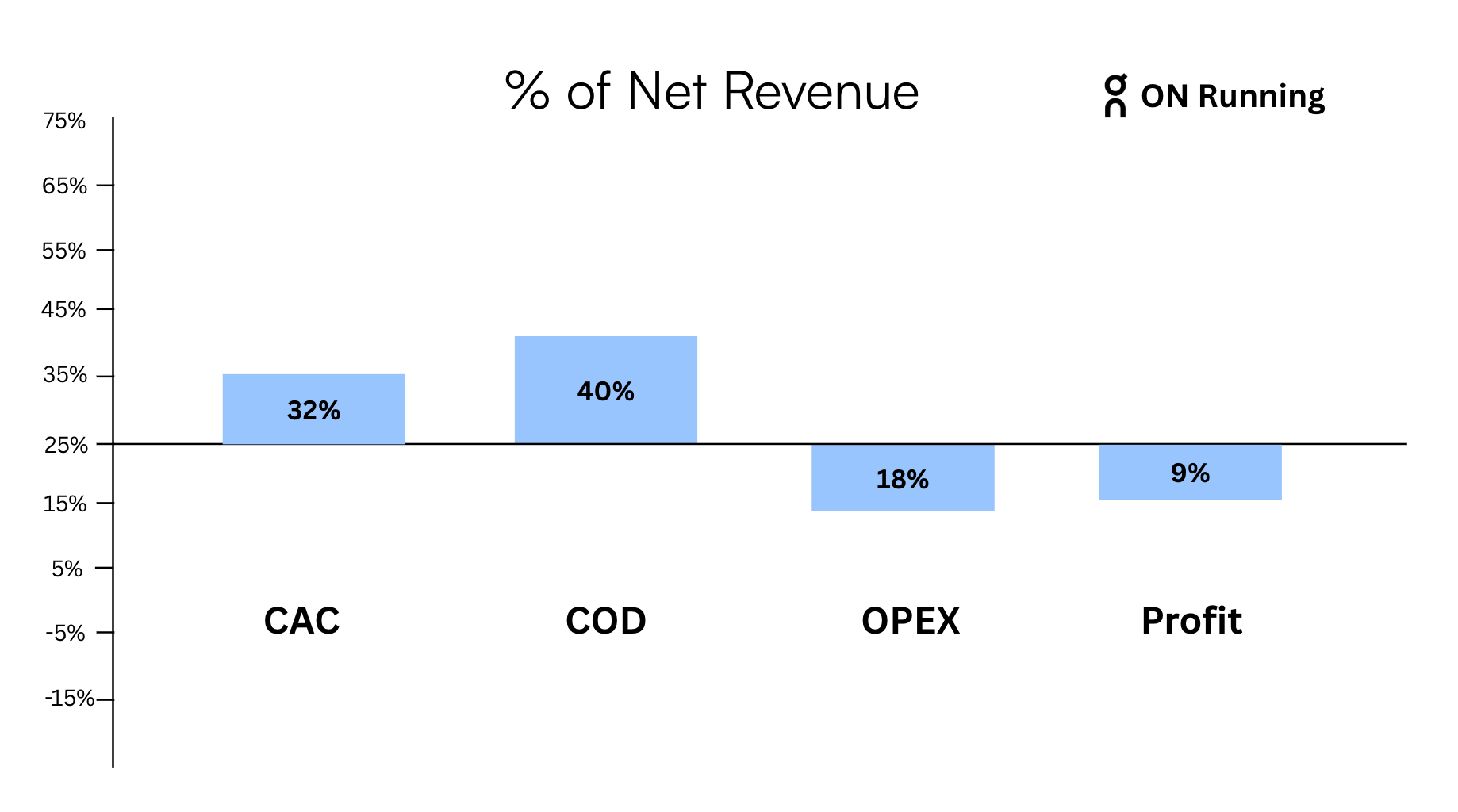

Comparison: ON Running vs Vivaio Portfolio Brand

Take ON Running, a well-known brand in the performance footwear space. Their model looks like this:

Looking at their CAC you can see that ON invests heavily in brand marketing. Think high-profile sponsorships (e.g., tennis star Roger Federer), influencer partnerships, premium retail experiences, and performance storytelling. While CAC is significant, it’s supported by strong customer loyalty, premium pricing, and high LTV. As the brand continues to scale, this upfront CAC becomes more efficient over time.

COD is also high. ON’s COD remains high, driven by the complexity of serving a global wholesale network and a high percentage of B2B sales. While margins are strong, greater scale and a higher mix of direct-to-consumer sales could help improve this metric.

Looking at their OPEX, they are well managed, reflecting disciplined investment in global growth. The company has strategically added talent, opened flagship stores, and expanded logistics all while maintaining efficiency.

The Bottom Line? ON is profitable with steady growth quarter over quarter. Their premium pricing and strong brand equity help protect margins, even with a high CAC and COD. This is what a healthy growth story looks like: not perfect, but moving toward balance.

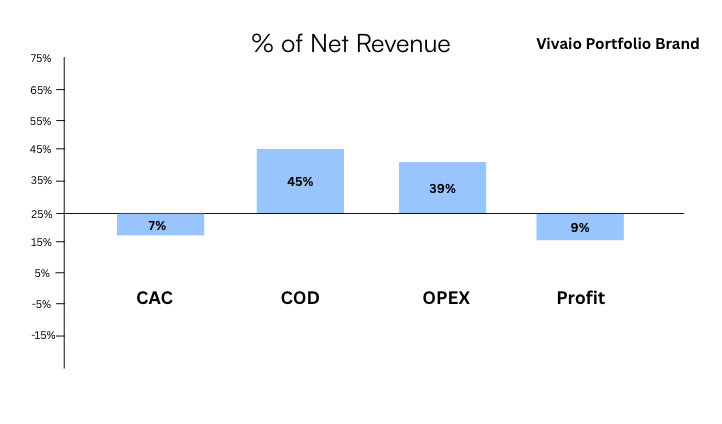

Now compare this to one of Vivaio’s portfolio brands - an emerging fashion brand based in Milan…

This brand has strong fundamentals but also clear opportunities to unlock the next stage of growth.

The brand is in a strong position with a low CAC driven by organic reach, word-of-mouth, and strong brand loyalty. As their partner, we see this as a key opportunity. The low acquisition spend indicates untapped growth potential. We’re actively working with the team to scale paid media, creator partnerships, and performance marketing to drive revenue growth more aggressively.

Their COD is heavy largely due to sub-optimal supply chain management and artisanal production methods. This is common at an early growth stage. We've already taken corrective actions to scale manufacturing, streamline packaging, and improve fulfillment. As these changes take effect, we expect meaningful margin improvement over time.

Looking at OPEX, fixed overhead is currently high relative to the size of the business. We're now working with the team to ensure these costs are more effectively leveraged. The foundation is in place, now it's about scaling into it. As revenue grows, fixed costs become scalable assets, and operational efficiency improves organically.

The Bottom Line? Although profitable, the brand is constrained by high COD and elevated OPEX. We're focused on helping the team invest more confidently in CAC to drive growth turning scale into margin expansion over time.

Final Thoughts - Know Your Levers and Use Them:

By comparing Vivaio’s portfolio brand to ON Running we can see how two very different brands prioritize different levers to improve their bottom line and future growth. In the early stages, investing more in growth (CAC), while tightening operations behind that growth, can help an early stage brand unlock real scale.

At Vivaio, we use this model for all Vivaio partner brands as a quarterly check-in. It brings structure to strategic conversations and helps you zoom in on the single lever that will make the biggest difference, whether it’s CAC, COD, or OPEX.

Start by visualizing your current breakdown. Then ask: Which of these four quarters can I influence this quarter? There’s no perfect formula. But there is power in knowing your numbers and making smarter, sharper decisions with them.

Thanks for reading and stay tuned for our upcoming newsletters!

-the Vivaio Ventures Team-

Like What You Read?

If this framework helped you think differently about your brand levers, we’d love to hear from you. 📧 Reply to this email or share your thoughts on LinkedIn - we read every message!

📧 Did someone forward this to you? Sign up here to get the next one straight to your inbox.

🤝 Want help applying this model to your brand? Get in touch! We work hands-on with founders and operators through Vivaio.

📱 Follow us on Instagram (@vivaio_ventures) & TikTok (@VivaioVentures) for more engaging content on the creator economy.